MGM bids expected soon - several non-disclosure agreements received |

Bond News - 27-12-09

The possible sale of MGM -- one of Hollywood's longest-running dramas -- will come into focus in the next few weeks when the first bids are expected to be submitted.The Lion, which put itself up for sale Nov. 13, has received several non-disclosure agreements back from potential bidders, a source close to the process indicated. It sent out over 20 NDAs last month out as a prelude to bidders seeing MGM's internal books - reports Variety.

It's not a given that MGM will be sold. The beleaguered studio has left open the door to continue operating as a standalone entity or forming some kind of strategic partnership if MGM's 140 debtholders agree to do so, possibly through a prepackaged bankruptcy. The bondholders have agreed to hold off receiving interest payments until Jan. 31 in order to enable management to find out the actual value of the assets and whether it should proceed with a formal auction.

And in a sign underlining the uncertainty facing MGM, studio chief Mary Parent has retained powerful attorney David Boies, according to a rep for his firm Boies Schiller & Flexner. The rep refused to elaborate Monday and Parent -- hired in March 2008 as chairman of the worldwide motion picture group -- wasn't available for comment.

MGM has released only one movie this year -- a revamp of "Fame" that cumed just $22 million domestically -- and has slotted "Hot Tub Time Machine," "The Zookeeper" and "Red Dawn" next year and "Cabin in the Woods" in 2011. It's a co-financer with Warner Bros. on the two "Hobbit" films, expected to begin production this summer in New Zealand with Guillermo Del Toro directing.

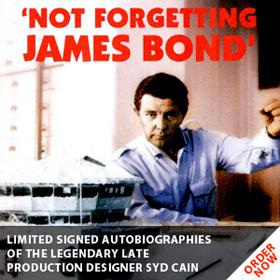

MGM's assets -- a 4,000-title library, the logo, the United Artists operations, rights to the James Bond and Pink Panther franchises and half-ownership in the upcoming "Hobbit" films -- are expected to fetch somewhere between $1.5 billion and $2 billion. Speculation has focused mostly on Time Warner Inc. as a likely bidder, since it has over than $9 billion in cash from the recent spinoff of its cable systems and would regain full control over "The Hobbit." Time Warner also owns the pre-1985 MGM library through its 1996 buyout of Turner Broadcasting and made an eleventh-hour bid in 2004 for MGM but was topped by an investor group led by Sony.

News Corp., Lionsgate and Liberty Media have also emerged as possible bidders although it's been reported recently that News Corp. may not bid due to concerns over restrictions in the non-disclosure agreement. Reps for Time Warner, News Corp. and Lionsgate have refused to comment.

MGM carries a debt load of $3.7 billion from the Sony buyout along with payments due next April on its $250 million revolving credit facility. Harry Sloan was replaced as MGM's CEO in August summer by turnaround specialist Stephen Cooper.

MGM was taken private in 2005 by a consortium led by Sony, Providence Equity Partners, Texas Pacific Group and Comcast Corp. The group paid $2.85 billion and assumed $2 billion in debt as part of the purchase.

Discuss this news here...

Discuss this news here...